Personal Pensions began life in 1988 and took over from their predecessor; Retirement Annuity Contracts (RACs). Personal Pensions (PPs) are, as they sound, a personal scheme to which investors may contribute either directly or in conjunction with their employer.

Monies invested in Personal Pensions are placed into funds, typically with life assurance or pension companies, but may also be invested in unit trusts and OEICs (via a pension wrapper).

Investments placed in a Personal Pension grow almost entirely free of tax and at retirement investors can take up to 25% of the funds value as a tax-free lump sum.

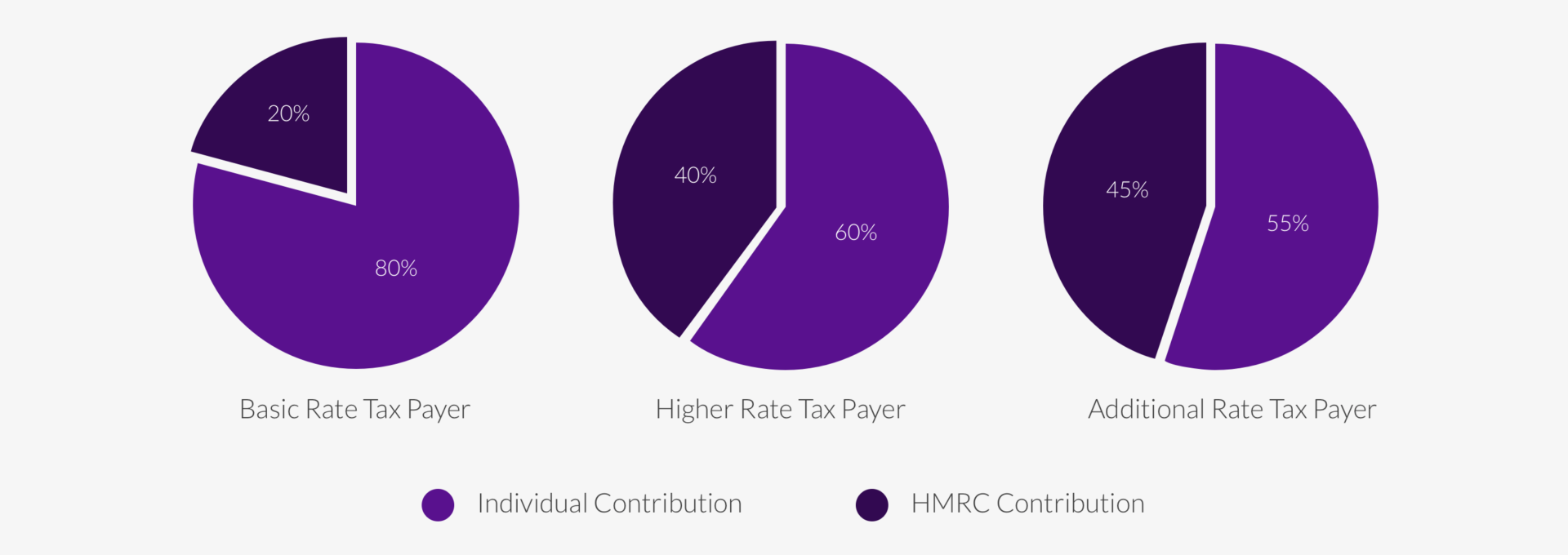

Tax Relief on Contributions

Contributions into a personal pension benefit from an HMRC top-up/rebate of £20 on each £100 paid in by basic taxpayers and £40 or £45 for higher and additional rate taxpayers (reclaimable via a tax return) making these vehicles one of the most tax efficient savings schemes in the UK.

Contributions may be by lump sum or regular payments, paid by the individual, someone on their behalf, or their employer up to their permitted maximum allowance. Employer contributions do not attract National Insurance and qualify for Corporation Tax Relief.

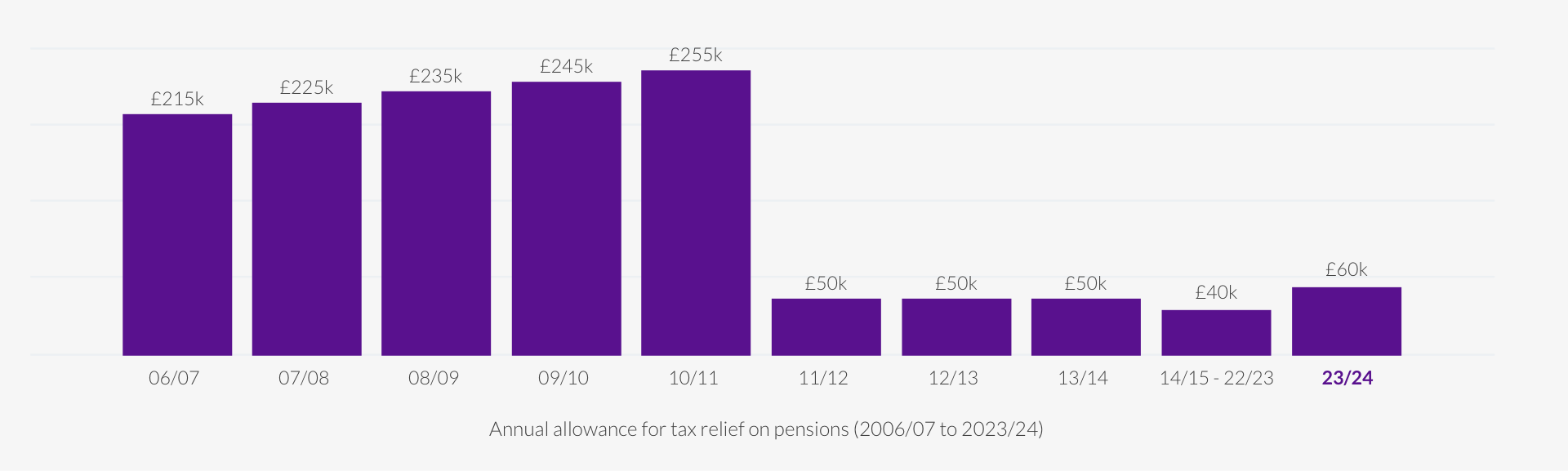

Annual Allowance

There’s a limit to the amount that can be invested in pension plans every year before an individual is taxed on the contributions. It’s set by the Government and it’s called the ‘Annual Allowance’

The current annual allowance is £60,000 pa.

If you are close to contributing up to the allowable limit it would be wise to seek advice from Rosan Helmsley to ensure the limit isn’t breached, which otherwise may trigger a tax charge. Also due to the way contributions are paid to pensions it is important to check the ‘Pension Input Period’ (PIP) to ensure contributions are maximised and allocated in the most tax efficient way.

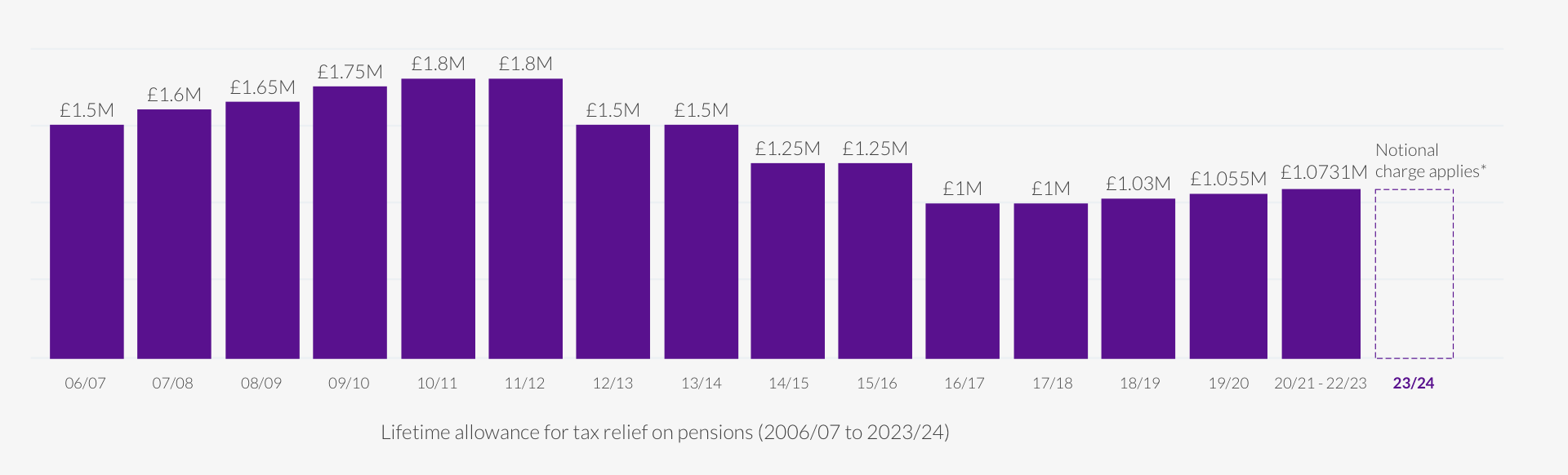

Lifetime Allowance

The Lifetime Allowance (LTA) is the total value of all tax-privileged pension savings held within an individual’s UK registered pension scheme.

In the Chancellor’s Budget Statement on 15th March 2023, he announced that from 6th April 2023, the LTA would be abolished. Therefore, from this date, the Lifetime Allowance Charge (LTAC) for individuals with excess pension benefits above their LTA, would no longer apply. However, the Finance Bill introducing the Budget changes, confirms that lump sum payments, which would have attracted the LTAC, will from 6th April 2023, have the LTA charge replaced with a charge to income tax at their marginal rate on the excess above their previous LTA.