SIPPs (Self Invested Personal Pensions) are the most tax efficient method of making provision for income in retirement. SIPPs have a range and flexibility of investment that makes them particularly attractive to those who wish to actively manage their pension investments.

A Self Invested Personal Pension (a specialist form of personal pension) is one of the most tax efficient ways of saving for retirement.

Unlike most forms of personal pension, a SIPP is independent of the investments it holds. This structure provides a range and flexibility of investment that makes a SIPP one of the most flexible methods of saving for retirement.

Flexible Investment

SIPPs can provide access to a far wider range of investments than a typical Stakeholder or Personal Pension. This enables the structure and risk profile of the underlying investments to be managed over time to suit individual circumstances.

SIPPs can include some of the more well-known types of investments as follows:

- Collective Investment Funds

- Unit Trusts

- Investment Trusts

- OEICs (Open Ended Investment Companies)

- ETFs (Exchange Traded Funds)

- VCTs (Venture Capital Trusts)

- Insurance company managed funds and unit linked funds

- Stocks and Shares

- Individual UK, European, and US equities on recognised stock exchanges

- Gilts, corporate bonds, and other fixed interest securities

- Futures and options

- PIBs (Permanent Interest Bearing shares)

- CFDs (Contracts For Differences)

- Other Investments

- Cash deposit accounts

- Certain National Savings & Investments (NS&I) products

- Commercial property, land, and REITs (Real Estate Investment Trusts)

Tax Free Growth

Investments within a SIPP will accumulate free of any liability to UK income tax or capital gains tax, although tax deducted at source on dividends from equities can no longer be reclaimed.

Tax Relief on Contributions

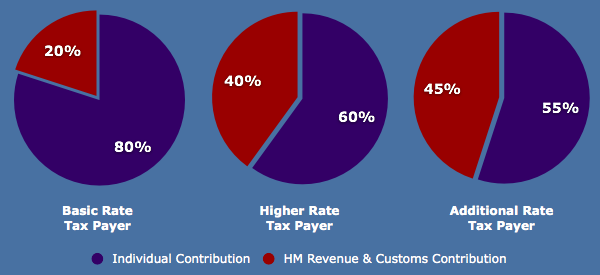

SIPPs enjoy all the tax advantages of a personal pension scheme, receiving tax relief at an individual’s highest marginal rate. Basic rate tax relief is available at 20% immediately and higher rate and additional rate tax payers will need to reclaim the remaining 20% or 25% via their tax return.

Contributions may be occasional lump sums or regular payments, paid by the individual, someone on their behalf, or their employer up to their permitted maximum allowance. Employer contributions do not attract National Insurance and qualify for Corporation Tax Relief.

Annual Allowance

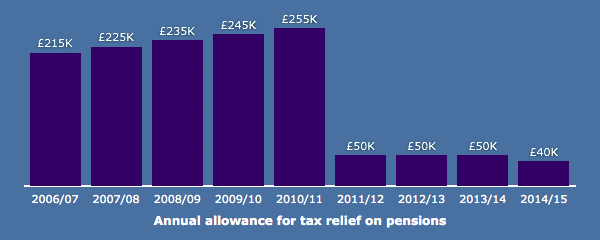

There’s a limit to the amount that can be invested in pension plans every year before an individual is taxed on the contributions. It’s set by the Government and it’s called the ‘Annual Allowance’.

The annual allowance has reduced from £50,000 (2013-14 tax year) to the current limit of £40,000 (2014-15 tax year).

If you are close to contributing up to the allowable limit it would be wise to seek advice from Rosan Helmsley to ensure the limit isn’t breached, which otherwise may trigger a tax charge. Also due to the way contributions are paid to pensions it is important to check the ‘Pension Input Period’ (PIP) to ensure contributions are maximised and allocated in the most tax efficient way.

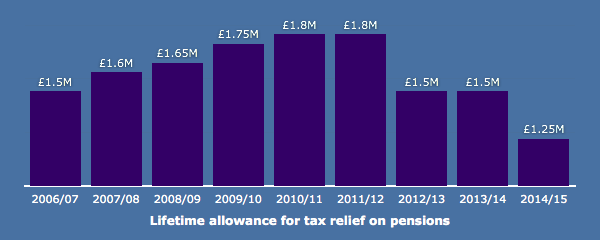

Lifetime Allowance

The ‘Lifetime Allowance’ is the total value of all tax-privileged pension savings held under all registered pension schemes, to which an individual is entitled. The lifetime allowance is currently £1.25 million (2014/15 tax year) which has reduced from the previous limit of £1.5m (2013-14). Accumulated pension benefits above the lifetime allowance are subject to a tax charge, even if the excess has resulted from good investment performance, unless you have previously applied for one of the protection options. The excess amount is subject to tax at 55% if the excess is drawn as a lump sum or 25% if the excess is used to provide additional retirement income.

Pension Consolidation

Benefits earned in other schemes may be transferred to a SIPP to consolidate investments and simplify the management and administration of holding various individual pension plans. If transferrable benefits are already held in flexible investments, then these may be transferred directly.

Flexible Income

SIPPs offer the widest range of retirement options, 25% of the fund may be taken as a tax free lump sum from the age of 55. The remaining funds are used to provide income in retirement, which is taxable. How an individual elects to draw their retirement income is now very flexible and includes options such as annuity purchase, income withdrawal, income drawdown and phased income drawdown.

Eligibility

Most UK residents under the age of 75 are eligible, including the employed, self-employed, pensioners, those in full-time education, and the unemployed. Contributions can be made by any individual, including grandparents and parents for their children. A contribution of up to £3,600 per annum can be made without reference to income.