If you offer your employees access to a personal pension, you can leave out commission, overtime and bonuses when you are calculating the 3 per cent minimum of basic pay that you contribute to your employee’s personal pension.

For example, you and your employee could both put in 5 per cent. The total amounts must, however, be within HMRC limits for how much you and your employee can contribute to a personal or Stakeholder pension in a year.

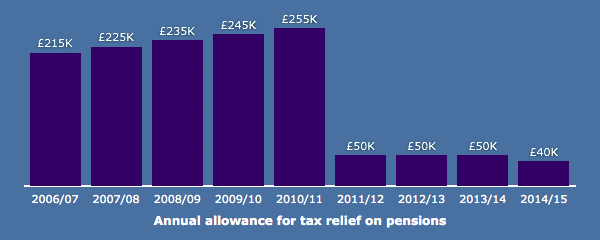

Contributions may be up to 100 per cent of earnings, up to a maximum of £245,000 per year during 2009/10, rising to £255,000 in 2010/11.

You must pay your employer contribution to the personal pension scheme provider, plus the employee contributions, within the stringent time limits.

You do not have to provide access to a Stakeholder pension scheme for any employee:

- Who has worked for you for less than three months in a row;

- Who is a member of your occupational pension scheme;

- Who cannot join your occupational scheme because its rules don’t admit people if they are under 18 or they are within five years of the scheme’s normal pension age;

- Who could have joined your occupational pension scheme but decided not to;

- Whose earnings have fallen below the National Insurance lower earnings limit for one or more weeks within the last three months;

- Who cannot join a Stakeholder Pension Scheme because of HMRC restrictions (e.g. the employee does not normally live in the United Kingdom).